|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

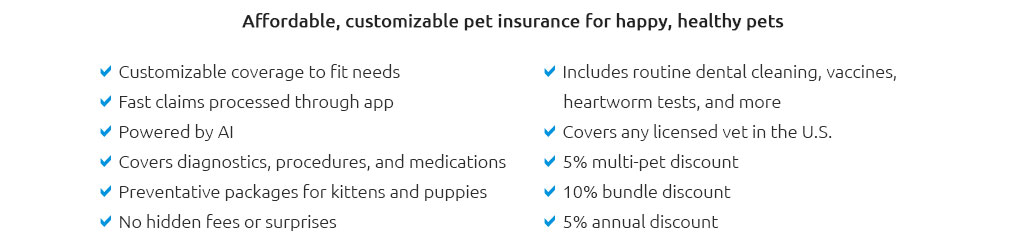

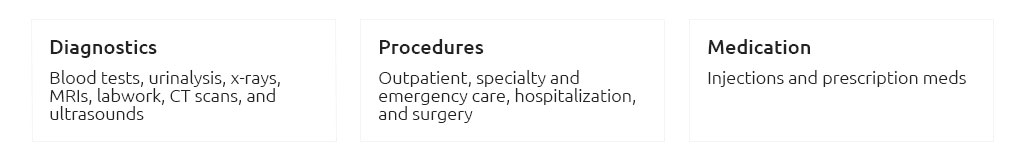

health insurance for dogs ny: a practical, research-backed guideWhat it does - and why it matters in NYVeterinary care in New York runs higher than the national median, especially around NYC and Westchester. Health insurance for dogs shifts the risk of unpredictable, high-cost treatment - trauma, cancer, cruciate tears - so a single event doesn't dictate medical choices. You still budget premiums; the plan absorbs volatility. Plan types and what they typically cover

Look for exam fee coverage, diagnostics (MRI/CT), rehab/alternative therapies, and prescription meds. Dental trauma is common; dental disease is often excluded unless you add wellness. Typical NY pricing (measured, not absolute)Recent quotes indicate monthly premiums for a young mixed-breed dog commonly fall in the $40 - $100 range in NY; brachycephalic or giant breeds and older dogs can exceed $120 - $150. Higher reimbursement, lower deductibles, and unlimited annual limits raise costs, sometimes by 10 - 25% per tier adjustment. Figures vary by ZIP and claims experience. Key mechanics to get right

A real New York momentSaturday rain in Astoria. Your Lab slips on subway stairs - knee injury. ER bill: $1,950. With an 80% reimbursement and a $250 annual deductible, the eligible amount is $1,700; reimbursement is $1,360. Your out-of-pocket is $590. If the exam fee isn't covered, expect a bit more. Regulatory notes in NYPolicies are overseen by the state regulator, which requires clear disclosures on waiting periods, pre-existing conditions, and benefit triggers. A "free look" period (commonly 30 days if no claim is filed) often applies, though terms can vary by carrier. How to choose - fast, but thorough

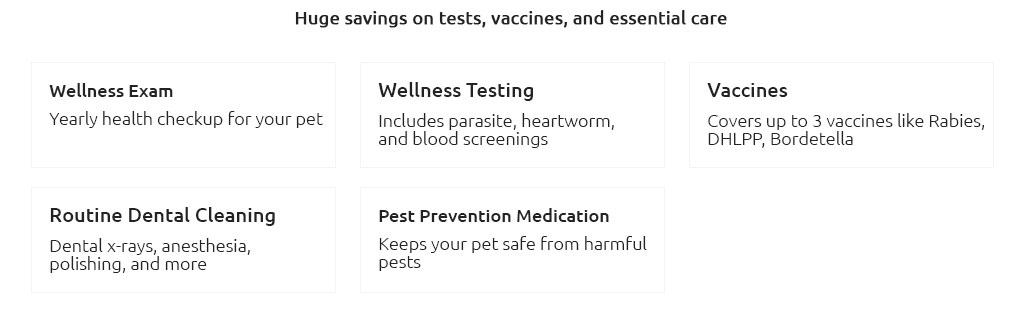

Wellness add-ons: buy or skip?If a wellness rider costs $20/month ($240/year) and reimburses roughly $250 for vaccines, fecals, heartworm tests, and a routine exam, that's close to even. If your clinic's preventive bundle is cheaper, skip the rider and pay cash. Common pitfalls to avoid

If you already have a dog in NYGather records from your vet portal before quoting. Photograph invoices. Note any past signs (even "mild limp") - they can define pre-existing status. Then compare at least three carriers with identical deductibles and limits so the price differences reflect underwriting, not settings. Bottom lineAction beats guesswork. Choose an annual deductible you can fund immediately, set reimbursement at 80% unless your budget demands otherwise, and pick a limit that realistically covers a major orthopedic or cancer claim in New York. The evidence suggests most households benefit not every month, but decisively on the few days that matter most.

|